There’s an involuntary recall, now what?

First, what’s an involuntary recall? This is when a governing or regulating body declares a certain product must be removed from the stream of commerce and supply chain. Businesses subject to industry regulation must comply and carry out the recall.

Inversely, a voluntary recall is when a manufacturer (or any other business along the supply chain) identifies a product defect that may or may not force an involuntary recall and proactively removes the product from the stream of commerce, mitigating risk of injury or illness.

Why is a product recalled? Contrary to what many believe, a known defect or confirmed threat to public health isn’t required to declare a recall. Improper packaging or labeling, compromised track and trace process of materials or ingredients, and potential contamination can all be triggers of a product recall.

Pyramid of Defense

Pyramid of Defense

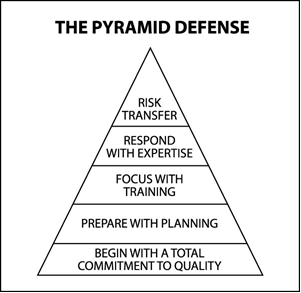

How can you best position your organization for handling a product recall? We recommend an approach called the Pyramid of Defense.

The first line of defense, the base of the pyramid, is a total commitment to quality. How can you eliminate most threats, such as contaminants, disgruntled employees, malfunctioning equipment, sloppy suppliers or lax testing?

Any threats that escape the first tier should be addressed by the second, and so on. As the pyramid rises, the plan becomes more specific and more effective at isolating and eliminating product incident threats.

Tier 1 - Total commitment to quality. The good news is that most of what can be done to protect against a product incident lies within quality assurance and control. Commitment to producing the highest quality products day after day is the best remedy to the threat of a product recall crisis. This dedication to quality should be evident in every aspect of business, from manufacturing to marketing to compliance. If the product can’t leave the facility in a contaminated or uncompliant state and the packaging is designed so that tampering is difficult (or obvious), the odds of experiencing a major incident are considerably reduced.

Tier 2 - Prepare with a contingency plan. It is essential to have a plan in place before a crisis arises. Research indicates that the first 48 hours of a major product incident are more crucial than the next 48 days. Every company should have a workable product recall and crisis management plan.

Tier 3 - Focus with training. Contingency plans aren’t of much use if they haven’t been tested and honed under simulated conditions to ensure the plan works.

Tier 4 - Respond with expertise and decisiveness. Even with a good team and a good plan, there is a place in a recall crisis for professional consultants.

Tier 5 - Transfer risk where possible. Even the best prepared companies can suffer substantial financial losses from a recall. Despite all precautions, a large-scale public recall can cost millions of dollars in extra expenses, lost profits, lost inventory, lost shelf space and lost market share. If it comes to this, the last line of defense is a solid product recall insurance program—one that indemnifies the multitude of extra expenses and losses in revenue that come with product withdrawals.

Transferring the Risk

Transferring the Risk

Here’s what you need to know about transferring risk associated with product recalls via insurance coverage.

Insurance for first-party losses caused by product tampering and contamination incidents is broadly labeled as product recall insurance. These policies help cover the additional costs of a recall, including product loss, costs to withdraw the product from the stream of commerce, product disposal, product testing, overtime wages and crisis management— these costs can be devastating because they arise at a time when a company's revenues are typically hardest hit.

There are several coverage forms, each designed to isolate some component of first-party product exposure. In the cannabis industry, the most common form of product recall insurance is product withdrawal expense coverage, which is an optional enhancement to a product liability policy.

Product withdrawal expense is typically reimbursement coverage for out-of-pocket expenses associated with a large-scale product withdrawal. It includes costs like extra temporary employees, overtime, public safety messages, special testing and handling, destruction and disposal costs and crisis management and/or PR consulting fees. Expense reimbursement coverage typically does not replace recalled or destroyed product, lost profits, defend or settle third-party liability claims, or pay for reputational rehabilitation expenses.

In addition to transferring risk, thorough risk management practices are essential to minimize the exposure and the cost of a recall event. Our team of experts can help secure the coverage you need and collaborate with you to develop a business contingency plan that meets your specific risk profile. Learn more here and contact us today at 314-725-1414.

We challenge the status quo to bring clarity and safeguard the financial well-being of our clients, their employees and families. Our main focus is to properly protect our clients' assets and to effectively address operational liability exposures that could be detrimental to the profit and long-term viability of the business and the people who have vested interest. As the cannabis industry continues to grow, our risk management mindset and ability to address emerging exposures has been an invaluable resource for our cannabis clients in other States, so we are very excited to start sharing our knowledge in our home state.